These days, one of the most important parts of hiring a contractor is making sure they are ‘properly insured’, (we have roof insurance story for you later).

These issues described herein apply to all contractors, but are even more critical to the roofing industry. Insurance companies will underwrite and rate contractors based on the nature of the work they perform. Also the rates applied to roofers are some of the highest in the industry. Do to this fact, many companies ‘loophole’ the roofing rates by avoiding the roofing endorsement. So telling insurance underwriters that they do not do roofing, or that they only do incidental roofing as a general contractor.

One thing to look for is a company that says it specializes in roofing. Thay may not have “Roofing” in its company name (i.e. Joe’s Contracting or AAA Home Improvements). If “Roof” is stated in the companies name it is generally difficult to say to your insurance company that you don’t primarily do roofing. We will describe below exactly how you can check out a potential contractor’s insurance.

What Covers What?

Contractors will carry two primary insurance policies:

- Workers Compensation: This insurance covers all employees for personal injury that work directly or indirectly for the company. Most New York companies, especially roofers, are covered by one company called the New York State Insurance Fund (NYSIF). Most other worker’s compensation carriers will not venture into the New York market due to its high risk of employee injury. Also in combination with unique New York State and county Laws that govern insurance companies. Note: any subcontractors may be used at your home should also have their insurance verified.

- Liability Insurance: This coverage covers all operations and liabilities of the contractor while performing your job. This includes any possible property damage or personal injury caused to anyone other than the direct employees during work operations. This insurance is the one that has incurred the most recent changes as of late. Again, do to the fact there is a risk of very high rate of claim in the industry. Many insurance companies have gotten very strict and very expensive in this field. ALL POLICIES WRITTEN FOR CONTRACTORS FROM CARPENTRY TO PLUMBING HAVE A SPECIFIC “EXCLUSION” FOR ROOF OPERATIONS. ONLY WITH A SPECIFIC “INCLUSION” IS A COMPANY ALLOWED TO PERFORM ROOFING OPERATIONS.

Actual Insurance Case

Here is an actual case of an owner for whom we have done a roof replacement. Roof Insurance Story that may happen to anyone

The home owner had hired a home improvement company to install roofing and siding at his home. During the removal of their existing roof systems, the contracting company left the house uncompleted during the roof construction process. Two subsequent days of wind and rain blew off the ‘felt paper’ (a protective covering temporarily installed to protect against such circumstances) and caused more than $50,000 in damage to the home. Upon making a claim to the contractor’s insurance company, they received the following reply: SORRY, THE INSURANCE POLICY FOR THE COMPANY YOU REQUESTED A CLAIM ON HAS LAPSED IN COVERAGE – THIS INSURANCE COMPANY IS NOT FINANCIALLY RESPONSIBLE FOR ANY DAMAGES INCURRED. BECAUSE THE POLICY WAS NOT UPDATED IN A TIMELY MATTER. THUS BREAKING THEIR CONTRACT.

How to verify Insurance

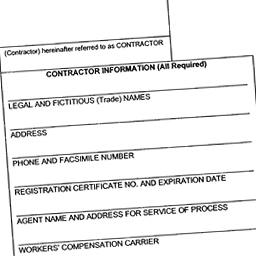

It is highly recommended that you verify a contractor’s insurance coverage prior to hiring any contractor – including us. Standard in the industry is an ‘Accord Form’ shown below. This is a cover sheet that shows companies that provide the insurance, policy numbers and policy dates. This form is generally provided by a contractor’s insurance broker and will list you as a certificate holder at bottom, if requested. Upon receipt of this document you should have all that you need to verify your contractor’s insurance coverage. Please do not assume that this is all you’ll need, for not only can these documents be altered, but the coverage can either be lapsed or improperly endorsed.

Here are a few steps you can use to be sure your contractor is (a) insured, and (b) properly endorsed for the work that is being performed.

In the top corner of the Accord Form is the broker’s name and phone number.

- Call the broker and request a verification of validity of the Accord Form that you currently posses.

- When calling the broker, request direct names and phone numbers for direct policy carriers of liability and worker’s compensation insurance. Note: insurance brokers work for the contractor, and may not give you accurate and/or honest answers about your potential contractor’s policy.

- Call both companies to verify both the policy’s validity, and that your contractor’s properly endorsed for roof replacement at your home or building. Upon completion of this process you can rest assured knowing the company working at your home not only has insurance, but is properly endorsed to perform roof operations.

How it should be

We will enclose a copy of our Accord Form at the time of your estimate. Please spend the time to verify the coverage plans we have described. Upon choosing us as your contractor we will further provide you with a certificate with yourself listed as a “certificate holder”, which will allow you to be notified within 30 days of any policy lapses. In New York it has become a common practice to obtain a certificate of liability insurance, listing the owner as ‘additionally insured’. Our insurance company charges an additional $125.00 per form for this endorsement. The laws of New York State are such that this clarifies the order of liability to put the contractor’s insurance as “primary” and may be a further coverage you may want to have.

Please make all your effort to hire properly insured contractors. Doing so will keep you safer, and the rates in the insurance industry manageable. For more information on Roof Insurance contact your local New York Roof Contractor today!