Insurance Story

(Not all insurances are created equal)

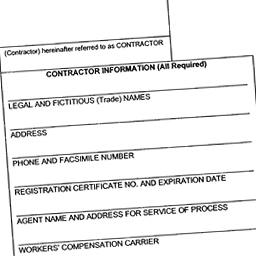

These days, one of the most important parts of hiring a contractor is making sure they are ‘properly insured’, (we have a roof insurance story for you later).

These issues described herein apply to all contractors, but are even more critical to the roofing industry. Insurance companies will underwrite and rate contractors based on the nature of the work they perform; and the rates applied to roofers are some of the highest in the industry. Do to this fact, many companies ‘loophole’ the roofing rates by avoiding the roofing endorsement, telling insurance underwriters that they do not do roofing, or that they only do incidental roofing as a general contractor.

One thing to look for is a company that says it specializes in roofing, but does not have “Roofing” in its company name (i.e. Joe’s Contracting or AAA Home Improvements). If “Roof” is stated in the companies name it is generally difficult to say to your insurance company that you don’t primarily do roofing. We will describe below exactly how you can check out a potential contractor’s insurance.